All Categories

Featured

Table of Contents

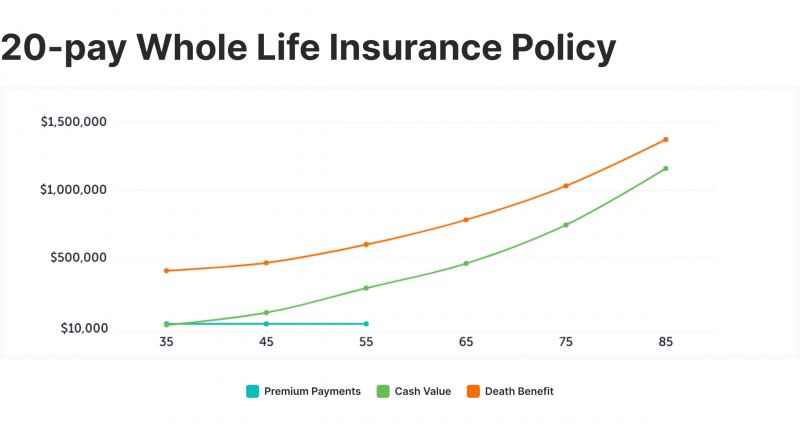

The are entire life insurance and global life insurance policy. expands cash value at an ensured rate of interest and likewise with non-guaranteed dividends. expands money value at a dealt with or variable rate, depending on the insurance firm and policy terms. The money value is not contributed to the survivor benefit. Cash worth is an attribute you capitalize on while active.

After ten years, the cash worth has actually grown to around $150,000. He takes out a tax-free finance of $50,000 to begin a company with his bro. The policy funding interest rate is 6%. He pays back the financing over the following 5 years. Going this course, the rate of interest he pays returns into his plan's cash money worth rather of a monetary establishment.

Think of never having to stress over small business loan or high rate of interest once again. Suppose you could obtain money on your terms and build wealth concurrently? That's the power of infinite banking life insurance policy. By leveraging the cash money worth of entire life insurance policy IUL policies, you can grow your wide range and borrow money without counting on conventional banks.

There's no collection financing term, and you have the flexibility to pick the settlement schedule, which can be as leisurely as repaying the funding at the time of death. This flexibility reaches the maintenance of the lendings, where you can choose interest-only repayments, maintaining the funding equilibrium level and manageable.

Holding money in an IUL dealt with account being attributed passion can frequently be much better than holding the cash on down payment at a bank.: You have actually constantly imagined opening your very own bakery. You can borrow from your IUL plan to cover the initial expenses of leasing an area, purchasing tools, and hiring team.

Banking Life

Personal lendings can be acquired from standard financial institutions and credit score unions. Obtaining money on a credit history card is usually really expensive with yearly portion prices of interest (APR) usually getting to 20% to 30% or even more a year.

The tax obligation treatment of policy finances can differ considerably depending on your nation of residence and the details terms of your IUL plan. In some areas, such as North America, the United Arab Emirates, and Saudi Arabia, plan financings are typically tax-free, providing a significant advantage. Nonetheless, in other jurisdictions, there might be tax implications to take into consideration, such as prospective tax obligations on the loan.

Term life insurance coverage just supplies a fatality benefit, without any money worth build-up. This implies there's no cash worth to obtain against.

A Life Infinite

When you initially find out about the Infinite Banking Idea (IBC), your very first response may be: This sounds also great to be true. Perhaps you're hesitant and think Infinite Banking is a rip-off or plan - royal bank infinite avion points. We wish to establish the document straight! The problem with the Infinite Banking Principle is not the principle however those individuals using a negative critique of Infinite Banking as a concept.

As IBC Authorized Practitioners with the Nelson Nash Institute, we thought we would address some of the top inquiries individuals search for online when discovering and comprehending every little thing to do with the Infinite Financial Concept. So, what is Infinite Banking? Infinite Financial was developed by Nelson Nash in 2000 and fully clarified with the publication of his book Becoming Your Own Lender: Open the Infinite Financial Concept.

Infinite Power Bank

You think you are coming out financially ahead because you pay no rate of interest, but you are not. With conserving and paying cash money, you may not pay passion, but you are using your cash as soon as; when you spend it, it's gone for life, and you offer up on the possibility to gain life time substance interest on that money.

Billionaires such as Walt Disney, the Rockefeller household and Jim Pattison have leveraged the properties of entire life insurance policy that goes back 174 years. Even financial institutions utilize whole life insurance for the same purposes. It is called Bank-Owned-Life-Insurance (BOLI). The Canada Earnings Firm (CRA) also recognizes the value of taking part entire life insurance coverage as a distinct property class used to generate long-term equity safely and naturally and supply tax obligation benefits outside the extent of standard investments.

Cut Bank Schools Infinite Campus

It permits you to produce wide range by fulfilling the financial feature in your very own life and the capacity to self-finance significant lifestyle acquisitions and expenditures without interrupting the compound interest. One of the simplest means to consider an IBC-type getting involved whole life insurance policy plan is it approaches paying a home loan on a home.

When you borrow from your taking part whole life insurance plan, the cash value proceeds to expand undisturbed as if you never ever obtained from it in the initial area. This is because you are utilizing the money worth and fatality advantage as collateral for a funding from the life insurance business or as security from a third-party loan provider (known as collateral lending).

That's why it's important to function with a Licensed Life insurance policy Broker licensed in Infinite Financial that frameworks your taking part whole life insurance policy policy correctly so you can stay clear of unfavorable tax obligation ramifications. Infinite Financial as a monetary approach is not for everyone. Here are several of the advantages and disadvantages of Infinite Banking you must seriously take into consideration in making a decision whether to move on.

Our preferred insurance carrier, Equitable Life of Canada, a mutual life insurance policy business, specializes in getting involved entire life insurance policy policies specific to Infinite Banking. In a common life insurance policy firm, policyholders are considered business co-owners and get a share of the divisible excess generated each year with returns. We have a range of providers to pick from, such as Canada Life, Manulife and Sunlight Lifedepending on the needs of our customers.

Please likewise download our 5 Top Questions to Ask An Unlimited Financial Agent Prior To You Employ Them. To learn more concerning Infinite Financial visit: Please note: The material provided in this e-newsletter is for informational and/or educational functions only. The information, opinions and/or views revealed in this newsletter are those of the writers and not always those of the representative.

Royal Bank Private Banking Infinite Visa

Nash was a finance professional and follower of the Austrian institution of business economics, which promotes that the value of goods aren't explicitly the result of typical financial frameworks like supply and need. Instead, individuals value cash and items in a different way based on their economic standing and needs.

Among the challenges of conventional banking, according to Nash, was high-interest prices on lendings. A lot of individuals, himself consisted of, entered economic difficulty as a result of dependence on financial institutions. So long as financial institutions established the rate of interest rates and car loan terms, people didn't have control over their very own wealth. Becoming your very own lender, Nash determined, would put you in control over your monetary future.

Infinite Financial requires you to possess your economic future. For ambitious people, it can be the very best financial tool ever. Right here are the benefits of Infinite Financial: Perhaps the solitary most valuable element of Infinite Financial is that it boosts your money circulation. You do not require to experience the hoops of a standard financial institution to get a loan; merely demand a plan funding from your life insurance coverage business and funds will certainly be provided to you.

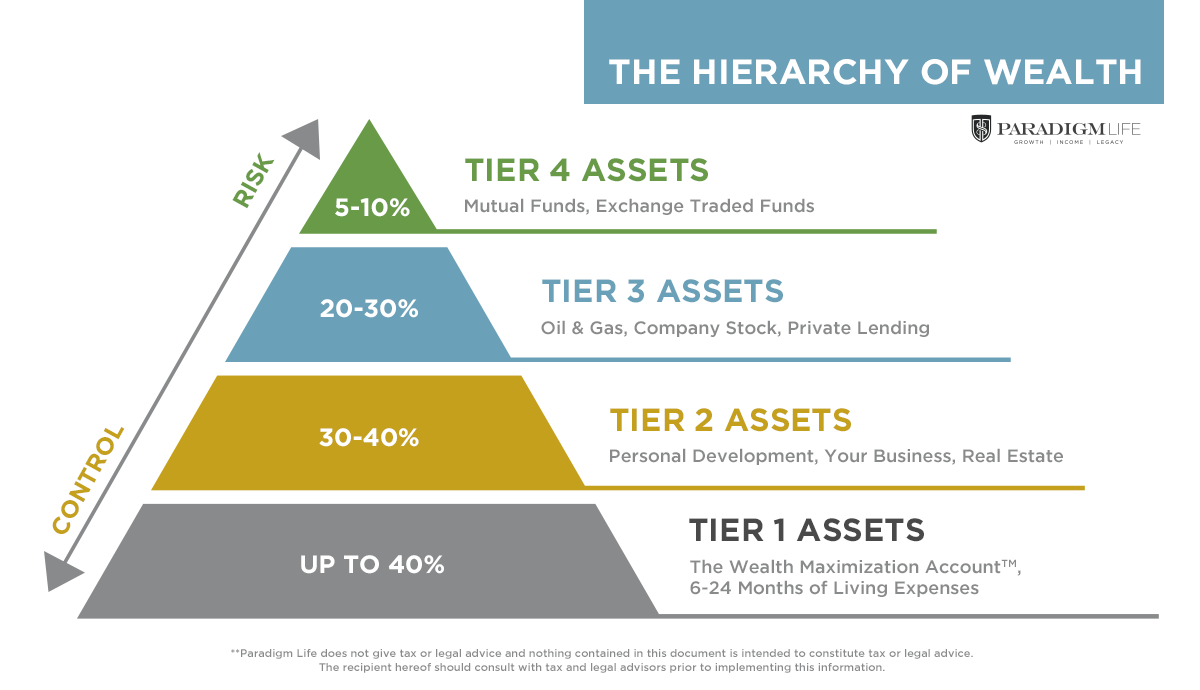

Dividend-paying entire life insurance coverage is very reduced risk and supplies you, the insurance holder, an excellent bargain of control. The control that Infinite Banking offers can best be organized into 2 classifications: tax benefits and property securities.

Whole life insurance coverage plans are non-correlated properties. This is why they function so well as the monetary structure of Infinite Banking. Regardless of what happens in the market (supply, genuine estate, or otherwise), your insurance policy maintains its worth.

Market-based investments expand riches much faster yet are revealed to market fluctuations, making them naturally dangerous. Suppose there were a 3rd container that used safety yet also modest, guaranteed returns? Entire life insurance is that 3rd pail. Not just is the price of return on your whole life insurance plan ensured, your survivor benefit and costs are also ensured.

Infinite Banking Testimonials

Infinite Financial charms to those seeking greater economic control. Tax obligation performance: The money value grows tax-deferred, and plan loans are tax-free, making it a tax-efficient tool for constructing riches.

Possession defense: In many states, the money value of life insurance policy is safeguarded from financial institutions, including an extra layer of monetary protection. While Infinite Banking has its values, it isn't a one-size-fits-all remedy, and it comes with substantial disadvantages. Below's why it may not be the ideal approach: Infinite Financial commonly needs detailed policy structuring, which can puzzle policyholders.

Latest Posts

Create Your Own Banking System With Infinite Banking

Paradigm Life Infinite Banking

Non Direct Recognition Life Insurance Companies